Trade deficit under microscope

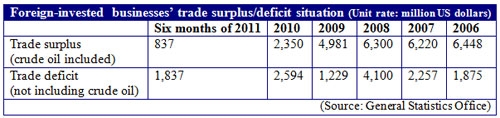

Statistics show that the foreign-invested sector’s trade surplus was chiefly attributed to its high crude oil export value.

According to Ministry of Planning and Investment’s Foreign Investment Agency deputy head Nguyen Noi, both the import and export value of crude oil should be excluded when appraising the FDI sector’s import-export performance.

“This will ensure impartiality and give accurate figures about the sector’s import-export business,” Noi said.

His proposal was upheld by economist Vu Dinh Anh.

However, when concrete import figures of crude oil trading firms are not yet in place, statistics indicated the sector’s year-on-year trade deficit hike. Accordingly, the sector incurred around $1.87 billion in total trade deficit in 2006, nearly equal to first half of 2011’s figure of $1.83 billion.

“It should be made clear whether the import hike benefits production or creates added value for the economy,” said deputy minister of Industry and Trade Nguyen Thanh Bien.

Anh assumed a higher import value might come in the wake of the sector’s shift from production into commercial trading.

Reality shows that the FDI sector and Vietnamese firms generally incurred high import values since the country’s supporting industries remained underdeveloped.

To service production and exports, a huge proportion of input materials and fuel is sourced externally. Import reliance not only badly affects the country’s balance of payments, but also erodes the competitiveness of the economy and local businesses.

Once local firms are chiefly engaged in export processing orders, their ambition to participate in the global value chain and ameliorate competitive edge is far beyond their grasp.

Industry experts suggest scrutinising why the FDI sector frequently incurred a trade deficit would be important to realise its actual contributions to national economy and find practical remedies.